Opportunity Zone

Port of Camas-Washougal Industrial Park & Steigerwald Commerce Center

The Opportunity Zone program was included in the Tax Cuts and Jobs Act of 2017, which was designed to provide tax incentives to investors who fund businesses in underserved communities. Washougal was one of the most impacted communities in the area during the Great Recession; approximately 17% of the city’s job base was lost as compared to 5% in most parts of the Portland metro area. With this program, investors are able to defer paying taxes on capital gains that are invested in Qualified Opportunity Funds that in turn, are used to invest in distressed communities designated as Opportunity Zones by the governor of each state.

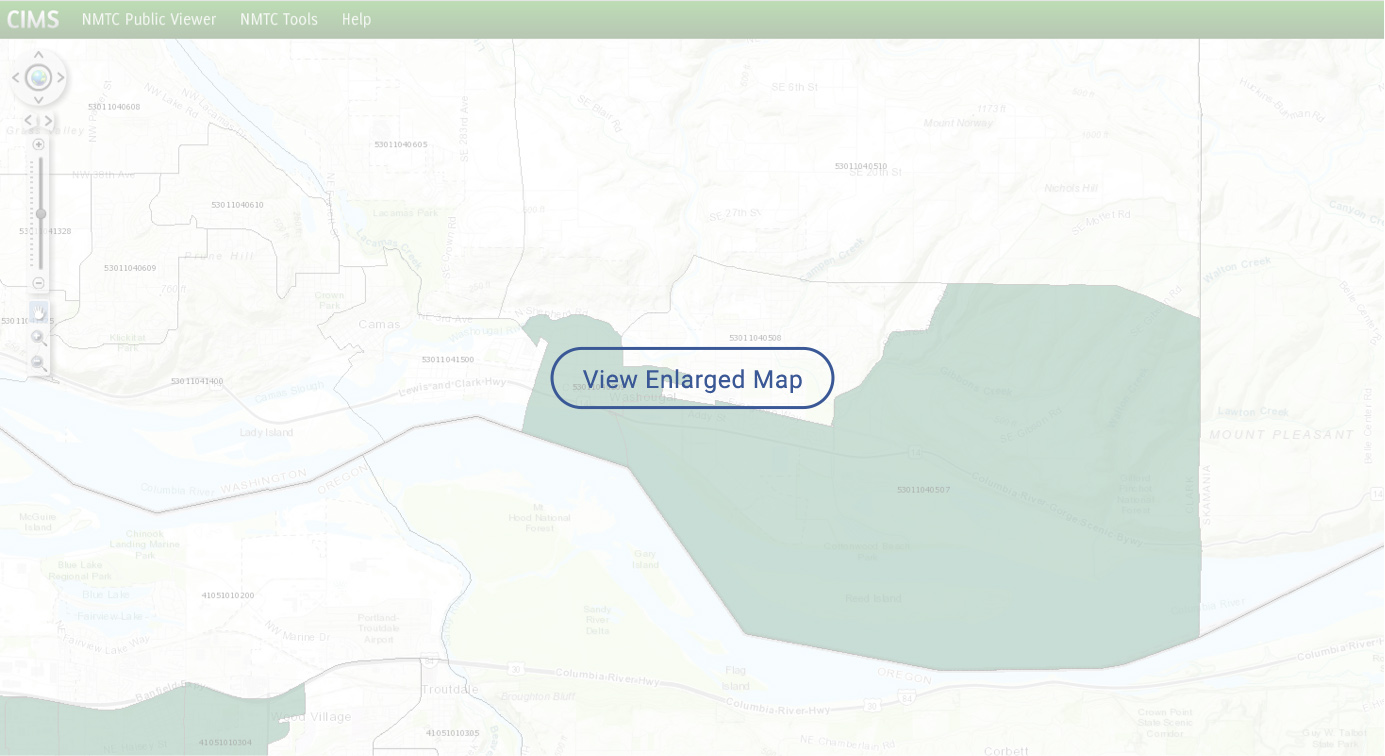

The Port of Camas-Washougal’s Industrial Park and Steigerwald Commerce Center are designated in a Qualified Opportunity Zone 53011040507 (see map above).

Paul Dennis, President/CEO of CWEDA said, “This program will help strengthen the momentum we’ve created over the last seven years with aim toward increasing citizens’ quality of life, reducing commute times for residents and giving them more access to family wage jobs. With the proper focus and investments in Washougal, CWEDA’s main goal to expand the existing base, support people, and create place will be realized in a way that truly creates an opportunity for long term economic prosperity.”

The Port of Camas-Washougal and the City of Washougal have been successful in attracting state and federal funding for infrastructure in recent years and the City has updated its long term Comprehensive Plan to focus economic development efforts downtown and at the port industrial area. Several projects within the designated tracts are in various stages of planning, and the Opportunity Zone designation will help attract capital that will lead to development.

The law passed by Congress in December of 2017 states:

- To qualify, capital gains must be invested in a Qualified Opportunity Fund within 180 days of the date of the sale or exchange that generated the gain.

- The tax deferral is temporary (up to nine years) and the program ends on December 31, 2026.

- Today, the U.S. Department of the Treasury and the IRS released proposed regulations (https://www.irs.gov/pub/irs-drop/reg-115420-18.pdf) on Opportunity Zones designed to incentivize investment in American communities. The Treasury Department plans on issuing additional guidance before the end of the year after notice and comment.

For Frequently Asked Questions please visit the IRS website at: https://www.irs.gov/newsroom/opportunity-zones-frequently-asked-questions